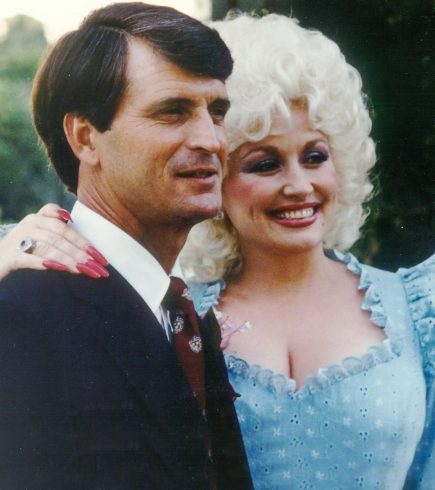

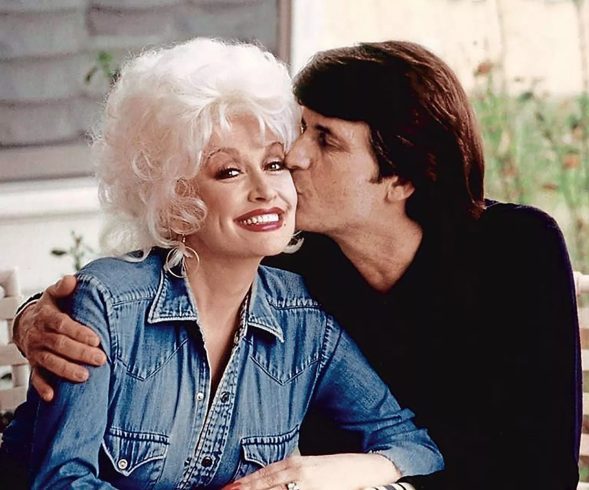

For more than fifty years, Dolly Parton and Carl Thomas Dean lived a love story that defied the glare of fame. While the world watched Dolly become a global icon — the voice of “Jolene,” the heart behind “I Will Always Love You” — the man she called home remained quietly in the background. Their bond, strong and steady, was theirs alone. When Dean passed away on March 3, Dolly wrote simply: “Words can’t do justice to the love we shared for over 60 years. Thank you for your prayers and sympathy.”

Their story began in the spring of 1964, at a small laundromat in Nashville. Eighteen-year-old Dolly had just arrived in the city, full of hope and determination. Dean, a local businessman, saw her loading her clothes into a washer and struck up a conversation. “He looked at my face,” she later recalled — something she joked didn’t happen often back then. Two years later, they slipped away for a quiet ceremony in Georgia, joined only by Dolly’s mother, a pastor, and his wife.

Dean never sought the spotlight. While Dolly’s star rose higher, he stayed content at home, happiest on their road trips through Tennessee or in small motels where they could just be themselves. “He’s completely different from me,” Dolly told Parade years later. “He’s not in show business. That’s what keeps it simple.”

They never had children, a fact Dolly came to see as destiny. “I often think it wasn’t meant for me to have kids,” she said. “So everybody’s kids could be mine.” Instead, she poured her love into family, fans, and the husband who remained her anchor through every triumph and heartbreak.

In 2016, to mark fifty years together, they renewed their vows at their home chapel in Nashville. “It was simple, just us and a few friends,” she told Rolling Stone. “We had fun with it.” That same year, she released Pure & Simple, an album of love songs inspired by Carl — “the different colors of love through the years,” as she described it.

Through it all, their secret was laughter. “We both have a warped sense of humor,” Dolly once said. “Even if we had a problem, we could always laugh our way out of it.”

Now, in the wake of his passing, Dolly admits that life without him is “a big adjustment.” But she finds comfort in her music, her work, and the memories of the man who was with her from the very beginning. “I’ll always miss him, of course, and always love him,” she said softly. “He was the best partner I could have ever asked for.”

Discuss

➜ Read more

Discuss

➜ Read more